Introduction

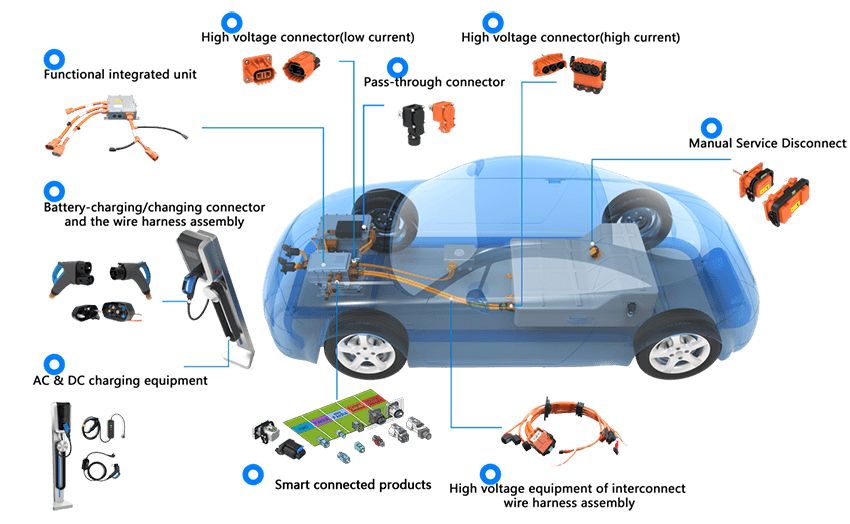

With the global penetration rate of new energy vehicles (NEVs) exceeding 35% (data source: China Association of Automobile Manufacturers), connectors have emerged as critical components in high-voltage electrical systems. Their technical performance and selection criteria directly determine vehicle safety, energy efficiency, and intelligent capabilities. This article systematically analyzes six core dimensions of connector selection, providing actionable insights for enterprises to seize technological high ground in the EV revolution.

I. Technical Parameters: The Foundation of High-Voltage System Performance

- Electrical Performance Optimization

- Voltage Rating: The 800V platform mandates connectors with a rated voltage ≥1000V DC (e.g., Ruike’s HVC800 series supports 1000V DC), while dynamic voltage fluctuations require EMC testing to validate shielding effectiveness (≥60dB standard).

- Current Capacity: Liquid-cooled ultra-fast charging demands connectors sustaining ≥650A continuous current (Huawei’s all-liquid cooling solution achieves 2400A), with contact resistance ≤5mΩ (Dingtong Precision’s components reach 3mΩ).

- Derating Curve: Current capacity decreases by 10% per 10°C ambient temperature rise, necessitating thermal simulation for terminal layout optimization (e.g., diagonal arrangement reduces localized heating).

- Mechanical and Environmental Resilience

- Plug/Unplug Lifespan: Charging interfaces require ≥10,000 cycles (national standard), while battery-swapping connectors need ≥5,000 cycles of floating compensation (NIO’s custom solution achieves 10,000 cycles).

- Vibration Testing: Compliance with IEC 60068-2-6 (10-55Hz, 30g) ensures contact resistance fluctuation ≤10% under -40°C to 125°C cycles.

- Sealing Protection: IP6K9K rating for mating interfaces (Shenglan’s fast-charging gun) and 48-hour salt spray resistance (Huland Technology).

II. Safety Design: From Passive Protection to Active Immunity

- Arc and Overload Mitigation

- High-Voltage Interlock (HVIL): Secondary unlock mechanisms with ≥1-second delay prevent live disconnection (TE Connectivity’s patented solution).

- Air Gap Design: Terminal spacing ≥6mm and creepage distance ≥8mm (per GB/T 31467.3-2015) to avoid air breakdown.

- Electromagnetic Compatibility Solutions

- Shielding Effectiveness: Metal shielding enclosures + 360° grounding (Amphenol’s HV series) or integrated cable shielding (Tesla’s approach).

- Interference Testing: CISPR 25 Class 5 compliance (≤34dBμV/m radiated emissions for Leadtrend’s 56Gbps connectors).

III. Material Innovation: Balancing Lightweighting and Durability

- Housing Material Advancements

- Lightweighting: Aluminum housings replacing copper alloys (Shanghai Huadong PCB’s integrated solution reduces weight by 30%), validated via 48-hour salt spray tests.

- High-Temperature Resistance: PBT+30% GF materials (140°C tolerance) for engine compartment applications (cost 40% lower than LCP).

- Conductive Material Upgrades

- Cu-Ni-Si Alloys: Conductivity ≥60% IACS, tensile strength ≥800MPa (replacing brass), used in high-voltage terminals (Celanez’s Zytel PA66).

- Laser Welding: Luxshare’s 4680 battery connectors achieve 50% contact resistance stability improvement.

IV. Certification Systems: Global Market Access Prerequisites

- International Certification Matrix

- Safety Certifications: UL 4128 (energy storage), T05V 2PfG 2740 (PV), UL94 V0 flammability.

- EMC Compliance: CISPR 25 Class 5 (≥60dB shielding).

- Domestic Standards Evolution

- GB/T 31467.3-2015: Mechanical lifespan ≥50 cycles, temperature rise ≤55K.

- CQC 1104-2025: New 800V platform certification requiring ≥400A current capacity.

V. Supply Chain Resilience: Risk Mitigation and Cost Optimization

- Dual-Track Supply Strategy

- Core Suppliers: Maintain 30% production flexibility (Luxshare’s Mexico plant: 5M units/year capacity).

- Contingency Planning: Localized EU/North American supply chains (AVIC Optoelectronics’ European base).

- Lifecycle Cost Control

- Liquid Cooling: Initial cost 30% higher but maintenance reduced by 50% (Huawei’s 15-year lifespan solution).

- Localization: Leadtrend’s connectors replace Tyco products, cutting costs 20-30%.

VI. Future Trends: Technological Convergence and Industry Restructuring

- 800V Platform Adoption

- Market share to rise from 35% (2025) to 65% (2030), driving connectors toward 1500V tolerance (Joulwatt’s R&D focus).

- Integration and Intelligence

- CCS Modules: Connector-PCB integration (Shanghai Huadong) reduces harness weight by 30%.

- Digital Twins: Real-time connector health monitoring improves fault prediction accuracy to 95%.

Conclusion

The NEV connector market is transitioning from “functional compliance” to “performance-driven” differentiation. Enterprises must establish a holistic selection framework encompassing technical specifications, material science, certifications, and supply chain agility. As Celanese’s material experts emphasize: “The performance boundaries of connectors are ultimately defined by the competition between material innovation and engineering excellence.”

Data Sources: Parameters derived from Jielong World industry reports, Pacific Auto Engineering Standards, and Santei Certification Database. Case studies cover Tesla, NIO, and XPeng’s supply chain implementations.